Buying a Home? How the Serenity Prayer May Help

You may be frustrated while attempting to buy a home in today’s market. You may feel powerless to the process. How could YOU possibly know whether the current good news about housing will continue? There is no doubt that today’s real estate market is extremely difficult to navigate. However, we want you to know that thousands of homes sold yesterday, thousands will sell today and thousands will sell each and every day from now until the end of the year.

It is totally within your power to decide whether it is the right time for you and your family to move. Even in the current market.

“How?” Let’s look at the simplicity of the famous Serenity Prayer and apply it to buying a home in today’s real estate market.

“God, grant me the serenity to accept the things I cannot change; courage to change the things I can; and wisdom to know the difference.”

Accept the things you cannot change

The two main concerns many talk about when discussing the housing market are:

- the current lack of inventory impacting housing prices

- the impending raise in interest rates

As an individual, there is very little you can do to impact either of those two situations. The best think-tanks in the country are struggling to discover what impact each of these items have on real estate.

Have the courage to change the things you can

Whether you are a first-time buyer or a move-up buyer and you believe now is the right time for your family to purchase a home – DO IT! Prices will only be higher later this year and though interest rates are rising they are still at historic lows. That means that your monthly housing expense will still be lower than almost any time in the last 50 years – and probably lower than your current rent payment.

The wisdom to know the difference

With the winter ending, the outlook on inventory is positive. Sellers will look to come out of hibernation and list their homes. The question is whether or not it makes sense to delay moving on with your life until everything gets ‘better’. Should you not buy a house and enable your kids to attend the school you have already decided is best for them? Should you spend another winter up north even though your doctor recommends you move to a climate better suited to your current medical situation?

This is where your wisdom must kick in. You already know the answers to the questions we just asked. You have the power to take back control of the situation by moving forward. The time has come for you and your family to move on and start living the life you desire. That is what truly matters.

Considering a home purchase, guve us a call, text or email and let us use our strategy to help you win in multiple offers!

Garage Staging Tips to Help Sell Your Home

Making a house on the market shine is all about attention to detail. If you’re going the extra mile to ensure your home is a stand-out, you’ll probably go beyond the typical touch-ups that refresh curb appeal. You might even decide to stage your home, especially if you’re not living in it while it’s for sale.

One “room” you don’t want to forget when you stage? Your garage!

Staging a garage may sound excessive, but it’s an important and frequently-used entryway to a home. While many prospective buyers may expect a dark, cluttered, unfinished concrete box, you can surprise and delight them by following these simple garage staging tips:

1. Clear out the clutter. Yes, it might mean renting storage space, but that can be a good idea anyway when you’re staging a home to impress. Weed through the junk, have your garage sale, and then store the balance off-site.

2. Enhance the floors. Cracked, stained, or otherwise shoddy looking concrete flooring can be a visual turn-off. If you’re not planning on sealing, priming, and painting the floor, at least get a suitable cleaning chemical or power washer to brighten up the flooring.

3. Organize what remains. A workshop area with hook boards for small tools can be appealing, especially if great care is taken to make the area look tidy and functional.

4. Create more storage space on walls or hanging from the ceiling. Provided your garage isn’t low-ceilinged or particularly tight, shelving and hanging racks can show your buyers how much room they’ll have to keep extra tools, seasonal decorations, or sports equipment handy.

5. Tune up the lighting. A nice hanging fluorescent fixture, plugged into outlets or existing fixture outlets can change your garage from a dungeon into a clean, inviting place. Besides, don’t you want to highlight all that hard work you’ve done?

Want to make your house stand-out in the Greater Seattle area marketplace? We're happy to share all the tips and tricks we have to give your home an edge. Let’s connect!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

5 Factors That Can Help Predict Neighborhood Values

How do you predict the value of a neighborhood? While no one can say for sure how home values in a neighborhood will rise or decline over time, there are big-picture economic factors that you can look for to help get handle on where they may be going.

1. Major regional employers. If a community depends upon one or two large companies for a high percentage of local employment, you can bet that as the company fares, so will the neighborhoods. While “company towns” are hardly the norm these days, don’t overlook the possibility.

2. Number of properties currently for sale. Sometimes there’s nothing wrong with a neighborhood just because the inventory (i.e. number of homes on the market) is high. Other times, something may be amiss. If you’re seeing street-after-street of “FOR SALE” signs, ask questions.

3. Major construction. Is that a new school they’re building, or is it a supermax prison? Did they clear that land for a new shopping center, or is it a new loop for the interstate? Certain types of construction can improve home values while others can hurt. Getting in touch with the local planning commission as well as the local newspaper’s business section (or website) can help illuminate what’s behind those bulldozers and cement mixers.

4. Rental density. People who own the homes they live in tend to take better care of them. Also, it’s preferable to have long-term neighbors versus high-turnover tenants. Absentee landlords or seasonally rented properties can also be a drag on a neighborhood. Get a feel for the rental density and the direction it’s heading. Rental density matters.

5. Environmental conditions. One industrial accident that poisons a water supply is enough to annihilate home values. How susceptible is the region to extreme weather? Don’t rule out environmental liabilities or benefits.

Nobody’s crystal ball is perfect, but to ignore major macroeconomic factors is dangerous. Even if you’re only planning on staying in a location for 5 – 7 years, do yourself a favor and try to position yourself to make, not lose money, on your home with these tips in mind.

Have questions about a neighborhood in Seattle or the Greater Puget Sound Area? We're happy to help. Get in touch today!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

One Financial Calculator to Rule Them All!

Financial health and stability depends upon making informed decisions about loans, debt, taxes, savings, and more. Unfortunately, most people (including first-time homebuyers!) lack a true understanding of how to apply math to help them clearly understand these essential areas.

While there are many specialized calculators out there for a particular area (say debt, or mortgage payments), there are few which consolidate all of the most popular financial calculators in one place. Not to mention, you can chalk up quite a bill paying $2 – $5 for each independent calculator you may need.

Recently I discovered CalcMoolator, a handy online collection of calculators which also has easy-to-use apps for both iOS and Android devices. The most popular calculators include:

- Auto Lease vs. Buy

- Auto Loan Estimate

- First-Year Baby Costs

- Estimate Your Credit Score

- Pay Off My Credit Card Debt Sooner

- My Lifetime Earnings

- Salary to Hourly Wage

- Rent vs. Buy

- What If I Pay More?

- Mortgage Payment Estimate

What's more, you can even embed web-based CalcMoolator calculators in your own website/blog. It's very handy for showing Rent vs. Buy and Mortgage Payment estimates.

Check out CalcMoolator for yourself:?

Thinking about getting your “financial house in order” before you buy real estate? Let’s connect!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

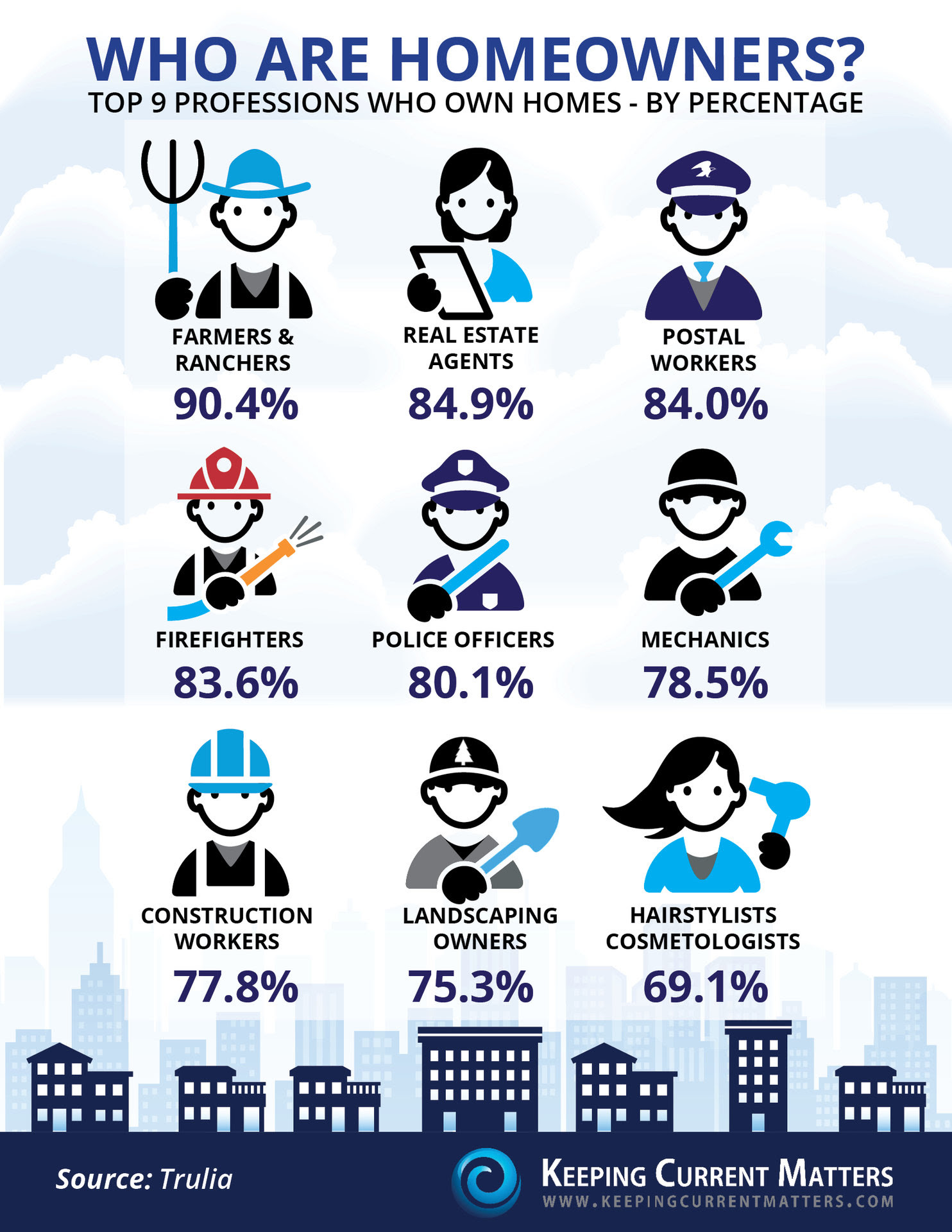

Who Are Homeowners?

Check out this infographic to see who homeowners really are, these statistics may surprise you!

Feel free to contact us anytime with your real estate related questions!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

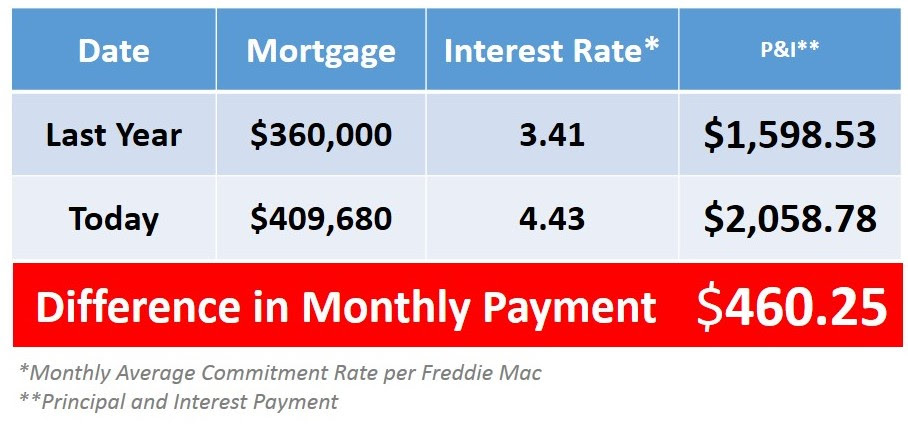

Moving-Up? Do it NOW not Later

A recent study revealed that the number of existing home owners planning to buy a home this year is about to increase dramatically. Some are moving up, some are downsizing and others are making a lateral move. Another study shows that over 75% of these buyers will, in fact, be in that first category: a move-up buyer. We want to address this group of buyers in today’s blog post.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

Assume they had a home worth $300,000 and were looking at a home for $400,000 (putting 10% down they would get a mortgage of $360,000). By waiting, their house appreciated by 13.8% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $341,400. But, the $400,000 home would now be worth $455,200 (requiring a mortgage of $409,680).

Here is a table showing what additional monthly cost would be incurred by waiting. If you have questions about current mortgage rates, be sure to contact one of our preferred lenders below.

-Steve and Sandra

Steve Hill and Sandra Brenner

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Seattle Real Estate Statistics

Check out all Seattle and Puget Sound area real estate statistics right HERE!

Check out all Seattle and Puget Sound area real estate statistics right HERE!

If you would like this type of information delivered to you every month for a specific neighborhood(s), send give us a call, text or email. We would be happy to send you this information for any area(s) you like. Don't worry, we won't spam you with other information you did not ask for!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Making Room in Your Rooms

Making Room in Your Rooms

|

|

The more things you have, the more you have to take care of. And in this case, the more that you have to store that gets in the way of finding the things that you actually use.

Periodically, you need to go through every closet, drawer, cabinet and storage area to get rid of the things that are just taking up space in your home and your life.

Every item requires the decision to retain or remove. Consider these questions as you examine each item:

• When was the last time you used it?

• Do you believe you’ll use it again?

• Is there a sentimental reason to keep it?

You have four options for the things that you’re not going to keep. If you know someone who needs it or will appreciate it, you can give it to them. You can sell it in a garage sale or on Craig’s List. You can donate it to a charity and receive a tax deduction or you can discard it to the trash.

Start with your closet. If you haven’t worn something in five years, get rid of it. Then, go through the things again and if you haven’t worn it in two years, ask yourself the real probability that you’ll wear it again.

Another way to do it is to move it from your active closet to another closet. If a year goes by in the other closet, the next time you go through this exercise, those clothes are on their way out.

If the items taking up space are financial records and receipts, the solution may be to scan them and store them in the cloud. There are plenty of sites that will offer you several gigabytes of free space and it may cost as little as $10 a month for 100 GB at Dropbox to get the additional space you need. It will certainly be cheaper than the mini-storage building.

We hope this article inspires you to get started on your Spring cleaning projects!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Should You Buy or Rent a Home?

Here is a simple chart that explains why we think buying a home makes more sense than renting one. This chart represents national monthly rental rates; currently, the average rental rate near downtown Seattle is $1500/month for a one bedroom apartment.

Here is a simple chart that explains why we think buying a home makes more sense than renting one. This chart represents national monthly rental rates; currently, the average rental rate near downtown Seattle is $1500/month for a one bedroom apartment.

A mortgage payment on a $250,000 home or condominium would be about the same as renting. If you are considering a home purchase, give us a call, text or email.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

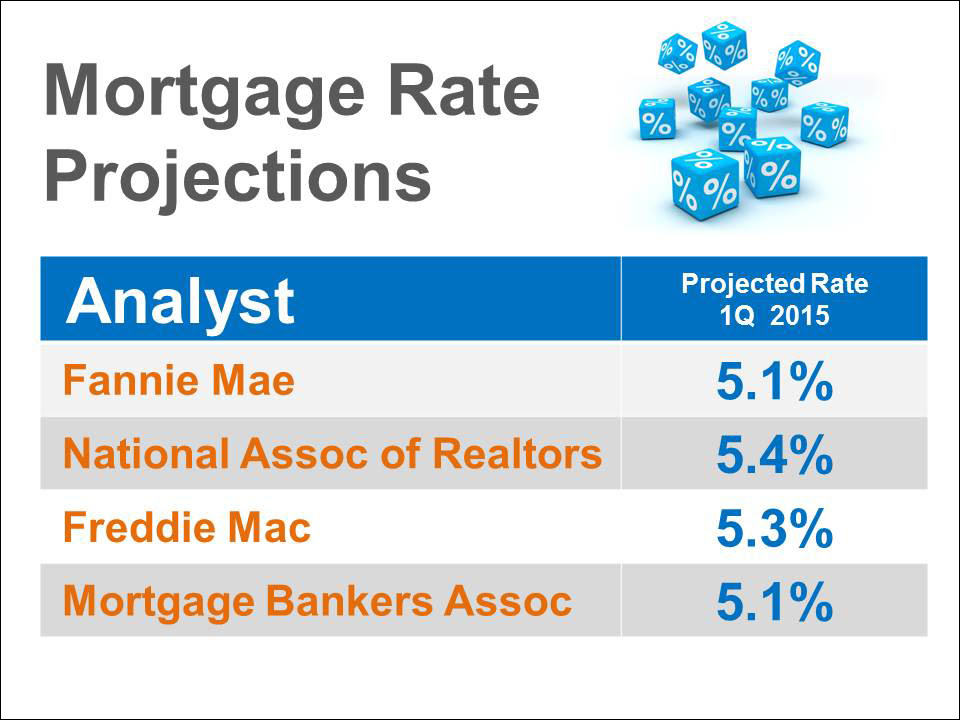

Mortgage Rates Projected to Rise as Tapering Continues

It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.

It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.

However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering:

“In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.”

What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:

If you have question about mortgage rates, give us a call, text or email. We will be happy to answer any of your real estate related questions.

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link