Homes Selling Faster Than Previous Year

By: Ashley Harris

By: Ashley Harris

Nationwide, homes listed for sale on Zillow were selling at a rapid clip, to the tune of a month faster in September than a year ago, according to a new analysis. Zillow measured homes sold on the real estate marketplace, and as a whole homes in September spent a median of 86 days on Zillow, down 30 days from 116 days in September 2012.

Among the 30 largest metro markets covered by Zillow in September, homes moved the fastest and spent the fewest days listed on the site in the Bay Area (48 days); Sacramento, California (59 days); and Dallas, Texas (60 days). Homes sold faster this September compared to last September in 30 of the largest metros. Those metros include Las Vegas (44 days faster), Sacramento (43 days faster), and San Antonio (37 days faster).

Zillow calculated the median number of days listings spent on Zillow, at the national, metro, and county levels, dating to January 2010. In order to correct for homes that are listed, then removed and re-posted with new prices, Zillow considered multiple listings within 40 days at the same address as one listing. Since the beginning of 2010, homes nationwide have spent a median of 119 days on Zillow before being sold or taken off the market.

“The declining inventory of for-sale homes over the past year naturally creates pressure for buyers to more quickly snap up the inventory that is on the market. This demand has been fueled by huge resets in home prices since market peak, historically low mortgage rates and a slowly improving broader economic climate,” said Dr. Stan Humphries, Zillow chief economist.

“Home shoppers in today’s environment need to be prepared to move quickly, with pre-approvals in place and an established sense of what they’re willing to pay for a home,” he continued. “But even though things are moving fast, buyers should resist the urge to enter into bidding wars or pay prices they’re uncomfortable with. We do expect that this need for speed will abate in the near-term as mortgage rates rise and more inventory becomes available because of new construction and declining negative equity.”

Are you curious about housing inventory in your neighborhood? Give us a call, text or email, we love to talk about real estate!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Corporate and Individual Relocation

Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world.

Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world.

Leading Real Estate Companies of the World® is a global network of over 500 premier real estate firms with 4,000 offices and 120,000 sales associates (brokers) in over 40 countries around the world. Our members dominate the US list of top 500 real estate firms.

Give us a call, text or email today, we would love to help you with your relocation needs!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Windermere, Real Estate, Northwest, Seattle, Mill Creek, Greenwood, Broadview, Home, Purchase, Sell

Ignoring Homeowner’s Insurance Risks Can Be Costly

by

by

Carrie Van Brunt-Wiley

Editor, http://homeinsurance.com

One of the first stages during the hunt for a new home is crunching the numbers to figure out your budget. And no matter how high or low that budget may be, prospective homebuyers should take into consideration the cost of insuring the home.

It's easy to overlook insurance, especially since you may be more worried about the number of bedrooms, the school district, or the size of the backyard. But before you can close on the purchase, your lender will require you to line up homeowners insurance. You may be hit with some sticker shock if the home you are about to buy ends up being a high risk- and therefore high cost- home to insure.

Once you’ve got a few homes in your sight, you should get some preliminary home insurance quotes on each property. Just as you will compare asking price and property taxes- figure your insurance costs into the equation as well. Even homes of similar size and style can vary greatly in terms of cost to insure.

Here are a few lesser known home features that affect insurance costs:

Location- The location of a home will have a huge impact on the insurance premiums due to the proximity to a fire station, the fire station ratings and the flood zone it’s located in.

- When you shop for homeowners insurance you will be asked how close the home is to a fire hydrant and to a fire station. In the event of a fire, the quicker the fire department can respond to the home, the less damage will be incurred. The average claim for a residential fire exceeds $33,000, according to the Insurance Information Institute (III). Therefore insurers typically charge lower premiums for homes within a close proximity of each.

- Fire stations in each community each have a specific fire protection class rating which also affects the home insurance premiums on a home.

- Last but certainly not least, the specific type of flood plain that a home is located in may require you to carry a separate flood insurance policy in order to obtain a mortgage. Flood insurance is recommended for all properties, however, in certain high-risk flood plains a flood insurance policy is not only required- but the coverage could double your annual insurance spend.

Roofing- Ask your realtor about the home's roof. You'll want to know how old it is and the material it's made of. Roofs that are 20 or more years old can be considered high risk and may be expensive to insure. Replacing a roof also can be costly so you'll want to weigh the pros and cons. Newer roofs, built with impact-resistant material, are ideal. These roofs are made to withstand nature's harshest elements, and they can also qualify homeowners for more preferred home insurance policies.

Swimming Pool- You might be looking specifically for a house with a pool but you should know swimming pools can drive up your insurance premiums. Accidents frequently happen in and around pools so insurance companies see them as a high-risk home feature. Remember, you can be held liable even if a trespasser has an accident at your pool. For this reason, homes with swimming pools located on the property should meet all local safety codes and carry high limits of liability coverage.

Age- The age of the home can also affect your premium. Typically older homes have outdated electrical wiring and plumbing systems, which can lead to fires or water damage. If you are considering an older home, ask your realtor the age of the plumbing, HVAC and electrical systems. If they have been updated in recent years, this is important to note with your insurance agent. If not, make sure you know what this may cost you in additional premiums and to upgrade in the future.

Security equipment- Security equipment is a plus for obvious reasons- items such as burglar alarms, deadbolt locks, and smoke alarms can make your home a safer environment. In addition, insurance providers offer discounts for homes featuring these items. In fact, you could save 10% or more on your premium. Take note of the types of safety devices in the homes you are comparing so you can get accurate discounts figured into your insurance rates.

You likely won't make a decision on a house because of insurance factors alone. But it's best to have an idea of where you stand as you consider your options. Start by checking out average home insurance rates in your state. Then work with an agent you can trust to compare quotes on various properties. An educated search can help you find the home of your dreams and home insurance premiums that won't break the bank.

Do you have other real estate questions? Give us a call, email or text. We'd love to answer any real estate related quesions you may have.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Where Home Prices are Headed over the Next 5 Years

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

The latest survey was released last week. Here are the results:

- Home values will appreciate by 4.3% in 2014.

- The average annual appreciation will be 4.2% over the next 5 years

- The cumulative appreciation will be 28% by 2018.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of over 16.8% by 2018.

Individual opinions make headlines. We believe the survey is a fairer depiction of future values.

Are you curious about current home values in the Seattle Puget Sound area? Give us a call, text or email, we love to talk shop!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

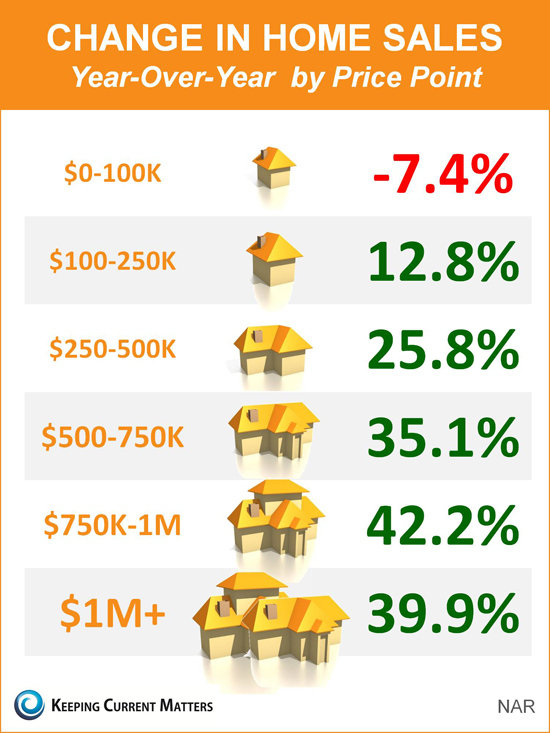

Home prices post strongest annual gain in nearly 8 years

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Pace of sales hits 5.36M a year during third quarter, best since 2007

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

Meanwhile, NAR said existing-home sales jumped 5.9 percent to a seasonally adjusted annual rate of 5.36 million in the third quarter from 5.06 million in the second quarter.

On an annual basis, they reportedly increased 13 percent. The third-quarter pace of sales was the highest recorded since the first quarter of 2007, when it hit 5.66 million, NAR said.

The report’s findings also highlighted the market’s sharp inventory shortage.

At the rate of sales in the third quarter, the existing-home inventory of 2.21 million homes for sale would have cleared in just five months, down from 5.9 months in the third quarter of 2012.

Are you curious what your home might be worth? Give us a call, text or email. We'ed be to provided you with a comparative market analysis of your home, condominum or multi-family home.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

How to Set Your Selling Price

Being overpriced is a bad start

Being overpriced is a bad start

If you're selling your house, one of the first steps you'll take is setting an asking price, a maneuver that requires the ability to find the perfect balance between attracting solid offers and ultimately receiving top dollar.

- Upgrades have been added. While many home improvements will help you recoup a good chunk of your investment, it won't give you 100 percent of what you paid. Also, the more personal the improvement—a swimming pool, a sunroom, purple floors—the less likely it will be viewed favorably by potential buyers.

- The need for money.

- You're moving to a higher-priced area.

- The original purchase price was too high.

- The seller lacks factual comparable sales to prove what the market value is.

- The seller wants bargaining room (listing more than 1-3 percent above market value actually reduces bargaining power).

- An unnecessary move, so you're not motivated.

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle – Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

FSBO’s Must Be Ready to Negotiate

In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family.

In a recovering market, some sellers might be tempted to try and sell their home on their own (FSBO) without using the services of a real estate professional. The real estate agent is a trained and experienced negotiator. In most cases, the seller is not. The seller must realize the ability to negotiate will determine whether they get the best deal for themselves and their family.

Here is a list of some of the people with whom the seller must be prepared to negotiate if they decide to FSBO:

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies which work for the buyer and will almost always find some problems with the house.

- The termite company if there are challenges

- The buyer’s lender if the structure of the mortgage requires the sellers’ participation

- The appraiser if there is a question of value

- The title company if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality if you need to get the Cos permits mentioned above

- The buyer’s buyer in case there are challenges on the house your buyer is selling.

- Your bank in the case of a short sale

If you are looking for a skilled negotiator to help you purchase or sell a home, give us a call, text or email; we would love to put our experience to work for you!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Seattle View Home Sale

Beautiful Seattle contmporary home for sale in Seattle's coveted North Beach neighborhood.

Open Saturday

November 9th

1PM-4PM

Custom built home is tucked away in North Beach w/ modern lines, perfectly situated on a private lot w/ sound views. High end materials & quality craftsmanship throughout. Light filled & open floor plan w/ a seamless flow to outdoor living. Two story entry. Top of the line kitchen w/ slab granite counters, ss package, gas cooking & a huge island w/ sit-up eating. Spa-like master bedroom w/ palatial bath. Work out room. Wine cellar. Custom built-ins + lots of thoughtful extras at every turn.

Stop by Saturday to see this great home.

If you are looking for something different, let us know. We are experts for North Seattle view neighborhoods. Give us a call, text or email. and put our experieince and negotiating skills to work for you!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834?

Five things to know about buying a fixer-upper

So you’re buying a fixer-upper? The house looks good, needs some work and is in a desirable neighborhood. But what might seem like a great fixer-upper property could actually be a money pit. Let’s look at some common potential issues with a home that could easily derail an appraisal and your mortgage.

Here are some common red flags that could halt your loan – and they come up more frequently than one might think. And just a note: It’s all about the appraisal and contract. If the problem isn’t listed in the appraisal or listed as a condition of sale within the purchase contract, it shouldn’t delay or deny your loan.

Roof

Many resale homes have worn-out roofs that must be replaced at some point down the road, some much sooner than others. In this situation, your real estate agent is bound to identify it right upfront. Get at least a couple of quotes to determine how much shelf life the roof actually has, and the costs associated with repairing or replacing the roof if need be. If the roof is shot (or worse — has a leak), and it’s identified in the appraisalas “subject to condition,” it will have to be fixed in accordance with the appraiser’s comments. It will also mean a second visit from the appraiser to sign off on the completion of the repair.

Open Subfloor

This one is biggie. Open and exposed subflooring is an automatic red flag because it presents a potential health and safety concern for the buyer of the property. As such, this is guaranteed to stop the loan, and the appraiser will be mandated to notate it in the appraisal as a condition that needs to be satisfied to make the property lendable

Exposed Wiring

This seems obvious, right? Well, in many cases homes have exposed wiring either on the exterior or the interior of the home, which poses — you guessed it — another health and safety concern. It would be best to repair any exposed wiring prior to the appraiser visiting the property for the first time.

Dry Rot

Whether or not a rotten area is viewed as a condition of hazard depends on the individual appraiser. In most cases, appraisers simply want a rotted area repaired to make an appraisal clean — and also to cover their backside, so to speak.

Pest Damage

If there is large-scale pest damage — for example, if any average Joe can see obvious termite or pest damage when viewing the home — then yes, it’s probably going to be need to be fixed. However, it’s more common to see it identified as a condition of sale in the real estate purchase contract — at which point it must be fixed.

Who Pays for the Repairs When Buying a Fixer-Upper?

Such repairs could be paid for by buyer, seller, listing agent or buyer’s agent. More commonly, the buyer typically pays for such repairs to the property, but this is always negotiable. It can be paid by any one of these parties, even be split multiple ways.

As an informed home buyer, you’d want to make sure your loan is approved with the lender prior to making any repairs. The last thing you want to deal with is fixing repairs on a property you don’t own yet when you’re loan hasn’t been signed off.

There are other repairs that inevitably come up when looking at properties, including the property needing a CO2 detector (which is a law in many states), obvious repairs such as broken windows or an unstable deck are all examples of health and safety concerns. It’s not the lender that delays the loan in these situations. Rather, it’s the scope of the repairs as notated by the appraiser, as well at the time it takes to have those items repaired, that can slow down the lending process.

Whatever the case may be, proactively communicating with your mortgage lender and real estate agent about any repairs that need to be done is the best course of action to take to ensure the financing for your purchase comes through.

Have other questions about investing in a home? Give us a call, text or email, we would love to answer any questions you may have.

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

Millennials: Your Time Is Now

Our guest blogger today is Justin DeCesare. Justin is the CEO of Middleton & Associates Real Estate and has some great advice for the Millennial generation in today's post.

Our guest blogger today is Justin DeCesare. Justin is the CEO of Middleton & Associates Real Estate and has some great advice for the Millennial generation in today's post.

There will likely be no other time in the lifespan of the Millennial generation that is filled with more opportunity than right now.

I understand that the preceding sentence may seem overly optimistic, but when we look at modern history, all generations flourished more in the decade following an economic downturn than any other.

This, coupled with exponential growth in technology, is currently paving the way for a wave of young entrepreneurs and successful business people unparalleled in our Millennial Timeline.

Generally, I write these blogs to help instill the importance of our generation to Real Estate Agents and Brokers, but today, my message is directly to you, the young Millennial Yourself.

If you have not already grasped the importance that the next five years are going to have on your life, do so today.

Get Pumped Up.

This isn’t high school anymore, and our teenage-angst should have been thrown by the wayside along with every other burdensome baggage we have carried along the way.

Prices are at their lowest, NOW

Economists around the country agree that housing prices have fallen to their true lows, corrected, and should now be back on track for the steady growth necessary to maintain a healthy market.

New housing inventory is minimal, and EVENTUALLY the government will be forced to curtail bond buying programs, and as monetary policy is contracted the price of borrowing will increase.

By far the greatest reason you have to buy a home NOW and not 2 years from now is that money is cheap… cheaper than it has ever been and cheaper than it will ever be.

Stop Renting!

Plus, when you are renting, you are throwing your money away in taxes, especially those single professionals who have no other write-offs.

I am a Millennial. I am 30. I bought my first home when I was 21 while I was enlisted in the Navy. My mindset has changed over the last 10 years, but I can say this: Youthful optimism may be the best asset we have. At 21, fear of failing and needing to start over with kids’ college funds to worry about do not weigh as heavily as they will 10 years from now.

Your jobs are starting to come back. With every tepid job report comes the chance for new jobs to be found that pay in line with what you are worth.

Take advantage of this time and don’t look back in 25 years saying, “It really was the best opportunity of my life.”

This is your opportunity for freedom, your opportunity to own something that gives back, and doesn’t merely suck the value out of your debit card.

Are you ready to invest in your future? Let us help you find the investment that works best for you. Give us a call, text or email today.

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link