Everyone wants a smooth home inspection. Sellers, buyers, agents… everyone’s rooting that this high-stakes moment passes without a hitch. Add to that list the home inspector, too! Save time, save money. If you’re selling, there are things you can do to make the home inspector’s job easier and help ensure the most accurate report possible.

1. Declutter your appliances. Get the pots off the stove, remove pans stored in the oven, take that bowl out of the microwave, and check the washer and dryer bins for clothes. While all of these appliances need to be tested, you don’t want an inspector rummaging through your laundry or scorching a pot to get the job done.

2. Replace burned-out lightbulbs. If a light switch doesn’t work, the inspector will need to determine if it’s a problem with the fixture itself. Take the time to hunt down those lightbulbs that might be out-of-the way, too… (Closets, attics, basements, guest rooms, etc.)

3. Keep access doors clear. You might have furniture blocking seldom-used crawlspace entrances, or the space for the pull-down stairs up to the attic may be obstructed. Make these entryways clear to the inspector and save them the time and hassle of getting into hidden areas.

4. Be honest about what doesn’t work. Don’t deceive your home inspector or hope they’ll overlook something. It’s bound to come out, and failure to disclose home defects can be a legal hassle down the line. Know the garbage disposal is broken? Say so. Leave notes for the inspector or prepare them in advance with an email message, etc.

5. Point out pumps and septic tank locations. If you have your own well and septic system, make sure the location of these is clearly described for the inspector. Annotate a photo or draw a simple map if need be.

6. Check your smoke and carbon monoxide detectors. People forget to change batteries in smoke and carbon monoxide detectors, and if you’ve neglected yours (or taken them down to change batteries and left them in the garage!) double-check to make sure they’re in place and functioning.

7. Get your furnace serviced. Inspectors will look for a recent service record sticker on the furnace during a home inspection. Ge the furnaced serviced if it has not been done in the last three months. This simple step could save you thaousands of dollars!

Naturally, this list assumes you’ve made any pre-inspection repairs you want to address. Want a more information about the home inspection process? Get in touch with us today!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N, Suite A

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

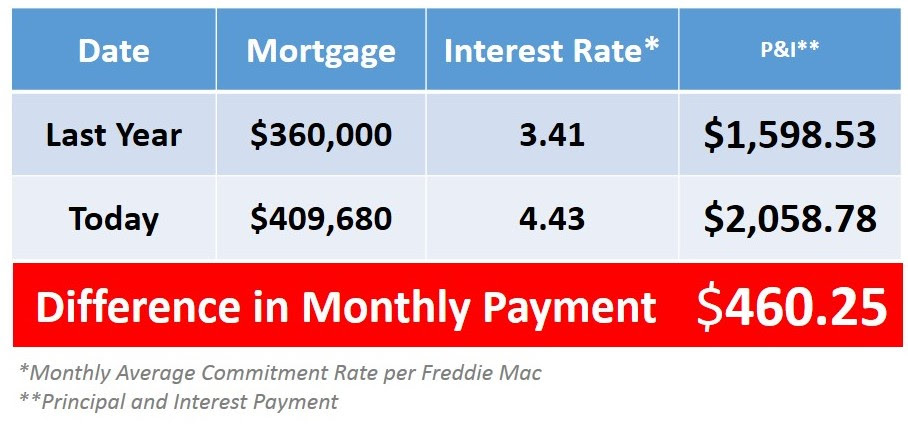

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead. Steve Hill and Sandra Brenner

Steve Hill and Sandra Brenner Check out all Seattle and Puget Sound area real estate statistics right

Check out all Seattle and Puget Sound area real estate statistics right