Negative equity falls at fastest rate on record!

The number of underwater homeowners fell at the fastest rate on record in the third quarter, but a recent slowdown in price appreciation means the pace of improvement will likely fade, Zillow reported.

Approximately 1.4 million homeowners who previously owed more on their homes than they were worth threw off the shackles of negative equity in the third quarter from the previous quarter. The share of homeowners with mortgages that have negative equity has fallen by about one-third since its peak in the first quarter of 2012 of 31.4 percent, or 15.7 million homeowners.

In the third quarter, 21 percent of all homeowners with a mortgage, or 10.8 million homeowners, were underwater, according to Zillow.

“Rising home prices and a greater willingness among lenders to engage in short sales have both contributed substantially to the significant decline in negative equity this quarter,” said Zillow Chief Economist Stan Humphries in a statement. ”We should feel good that we’re moving in the right direction and at a fast clip.”

Still, the pace of improvement is likely to decelerate due to slowing price gains, and negative equity is sure to continue to contribute to inventory shortages, Zillow said.

“… Negative equity will remain a factor for years to come, and must be considered part of the new normal in the housing market,” Humphries said. “Short sales will remain a persistent feature of the market as many homeowners remain too far underwater for reasonable price appreciation alone to help.”

– See more at: http://www.inman.com/wire/negative-equity-falls-at-fastest-rate-on-record/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+reindustrynews+%28Inman+News+Industry+News%29#sthash.C4vo177I.dpuf

The number of underwater homeowners fell at the fastest rate on record in the third quarter, but a recent slowdown in price appreciation means the pace of improvement will likely fade, Zillow reported.

Approximately 1.4 million homeowners who previously owed more on their homes than they were worth threw off the shackles of negative equity in the third quarter from the previous quarter. The share of homeowners with mortgages that have negative equity has fallen by about one-third since its peak in the first quarter of 2012 of 31.4 percent, or 15.7 million homeowners.

In the third quarter, 21 percent of all homeowners with a mortgage, or 10.8 million homeowners, were underwater, according to Zillow.

“Rising home prices and a greater willingness among lenders to engage in short sales have both contributed substantially to the significant decline in negative equity this quarter,” said Zillow Chief Economist Stan Humphries in a statement. ”We should feel good that we’re moving in the right direction and at a fast clip.”

Still, the pace of improvement is likely to decelerate due to slowing price gains, and negative equity is sure to continue to contribute to inventory shortages, Zillow said.

“… Negative equity will remain a factor for years to come, and must be considered part of the new normal in the housing market,” Humphries said. “Short sales will remain a persistent feature of the market as many homeowners remain too far underwater for reasonable price appreciation alone to help.”

– See more at: http://www.inman.com/wire/negative-equity-falls-at-fastest-rate-on-record/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+reindustrynews+%28Inman+News+Industry+News%29#sthash.C4vo177I.dpuf

The number of underwater homeowners fell at the fastest rate on record in the third quarter, but a recent slowdown in price appreciation means the pace of improvement will likely fade, Zillow reported.

Approximately 1.4 million homeowners who previously owed more on their homes than they were worth threw off the shackles of negative equity in the third quarter from the previous quarter. The share of homeowners with mortgages that have negative equity has fallen by about one-third since its peak in the first quarter of 2012 of 31.4 percent, or 15.7 million homeowners.

In the third quarter, 21 percent of all homeowners with a mortgage, or 10.8 million homeowners, were underwater, according to Zillow.

“Rising home prices and a greater willingness among lenders to engage in short sales have both contributed substantially to the significant decline in negative equity this quarter,” said Zillow Chief Economist Stan Humphries in a statement. ”We should feel good that we’re moving in the right direction and at a fast clip.”

Still, the pace of improvement is likely to decelerate due to slowing price gains, and negative equity is sure to continue to contribute to inventory shortages, Zillow said.

“… Negative equity will remain a factor for years to come, and must be considered part of the new normal in the housing market,” Humphries said. “Short sales will remain a persistent feature of the market as many homeowners remain too far underwater for reasonable price appreciation alone to help.”

Zillow forecasts that the negative equity rate will fall to 18.8 percent by the third quarter of next year thanks to a predicted home value gain of 3.8 percent in 2014

Curious about your home's value? Give us a call, email or text, we would love to chat!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

From White Picket to Upcycled Pallet Fences: Millennials and Housing

by Jim Harney

Critiques and defenses about Millennials abound. However, I think an overlooked aspect of the kerfuffle over Generation Y is the question “Why?” Although it is great to spur the generation on to great heights, it is crucial we understand some of the hurdles they are facing, economically and socially in order to anticipate how the market will have to change and adjust to accommodate a new generation’s capabilities and values.

Educational Debt & Credit

No big newsflash here: millennials are facing unprecedented levels of debt, between the various recessions, housing bubbles, and explosion of educational debt. New legislation in the works is attempting to help set up a more stable higher education financing system as well as relieve the staggering debt loads. Although debt forgiveness is the big buzzword these days, most students will still face shouldering a majority of their debt. Fortunately for the economic outlook, the legislation focuses on creating more income-based repayment plans that won’t put millennials on the street. However, the big question that remains is how will this affect their credit?

Public vs. Private Sector

With the specter of the 2008 housing bubble burst looming over everyone’s head, the situation is no longer about whether or not millennials are willing to take on more debt or have the income to cover minimum payments, it is about if lenders are willing to take on the risk. President Obama has rolled out plans that Fannie Mae and Freddie Mac will be gradually diminished, leaving the private sector to provide the backbone of risk management. With first-time buyers being edged out of the market due to new credit requirements, we could see a short-term slowdown in home-buying.

Uncertainty

Surprisingly, the instability recently exhibited by the U.S. government shutdown and continued clamor over the debt ceiling may actually work in the market’s advantage. Millennials, wary of being overly reliant on vacillating government promises, might become increasingly inclined to use their savvy to explore home equity loans and carefully consider newly-revised reverse mortgages as part of their retirement plans. Having front-row seating for the recent economic meltdowns, the newest generation will be more inclined to do their research and not bite off more than they can chew, meaning they might, actually, leave a positive legacy for the housing industry.

American Dream

Homeownership is still an important idea to many Americans. If the government and the private sector work together to slowly adjust the system and increase stability, which is already the direction we are driving in, we can expect to see homeownership continue to increase with this generation. However, we should expect to hold the memory of Desi and Lucy fondly in our hearts, and leave them there as the face of home buyers will be forever changed.

It is a pervasive misconception that millennials are thoroughly disenchanted with the concept of settling down. The revitalized home-making movement—as evidenced on social media platforms like Pinterest–within more progressive millennial circles would indicate that although it might take a bit longer for the birds to return from their explorations, they will inevitably nest.

It is a pervasive misconception that millennials are thoroughly disenchanted with the concept of settling down. The revitalized home-making movement—as evidenced on social media platforms like Pinterest–within more progressive millennial circles would indicate that although it might take a bit longer for the birds to return from their explorations, they will inevitably nest.

Furthermore, the creativity and frugality of Generation Y will provide them fresh incentives to invest in housing as home ownership opens up new avenues hosting friends and international travelers. As this new group of home-buyers realizes that a mortgage doesn’t necessarily clip their wings, we should be able to anticipate a new, stronger, and invigorated market of responsible borrowers. These iPod-wearing, tweeting, bicycle-riding youngsters just might be the market we’ve been looking for.

Please contact us with any of your real estate related questions, we would love to help you out in any way we can!

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

5 Reasons to Sell Before Spring

Many sellers feel that the spring is the best time to place their home on the market as buyer demand increases at that time of year. However, the fall and winter have their own advantages. Here are five reasons to sell now.

Many sellers feel that the spring is the best time to place their home on the market as buyer demand increases at that time of year. However, the fall and winter have their own advantages. Here are five reasons to sell now.

Only Serious Buyers Are Out

At this time of year, only those purchasers who are serious about buying a home will be in the marketplace. You and your family will not be bothered and inconvenienced by mere 'lookers'. The lookers are at the mall or online doing their holiday shopping.

There Is Far Less Competition

Housing supply always shrinks dramatically at this time of year. The choices for buyers will be limited. Don't wait until the spring when all the other potential sellers in your market will put their homes up for sale.

The Process Will Be Quicker

One of the biggest challenges of the 2013 housing market has been the length of time it takes from contract to closing. Banks have been inundated with both purchase and refinancing loan requests. Both of these will slow in the winter cutting timelines and the frustration these delays cause both buyers and sellers.

There Will Never Be a Better Time to Move-Up

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 25% from now to 2018. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with historically low interest rates right now. There is no guarantee rates will remain at these levels in years to come.

It's Time to Move On with Your Life

Look at the reason you decided to sell in the first place and decide whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

You already know the answers to the questions we just asked. You have the power to take back control of the situation by pricing your home to guarantee it sells. The time has come for you and your family to move on and start living the life you desire. That is what is truly important.

Are you considering selling? Give us a call, text or email. We would love to provide you with a complinetary Fall Seller's Guide, no obligation, we just like to share.

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Windermere, Real Estate, Northwest, Seattle, Mill Creek, Greenwood, Ballard, Ballard, Broadview, Home, Purchase, Sell

Seattle Homes Continue to Sell at a Rapid Pace

Over half of all home listed in Seattle sell in a month. It continues to be a seller's market. Check out the graphic below to see inventory and sales statistics.

Check out ALL the real estate statistics for the greater Seattle area HERE.

If you are considering a move, give us a call, text or email. We would love to help you sell your home for top dollar in rapid time.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

The Importance of Curb Appeal

Curb appeal is the attractiveness of your home's exterior when viewed from the street. Studies show that a majority of buyers will not get out their car if they do not find your home's curb appeal visually attractive–that is, if they visit your property at all. With more and more people shopping for homes online, potential buyers could be turned off from viewing your property, just based on the listing photo alone. Addressing your home's curb appeal is a critical component in marketing and selling your home.

Why is curb appeal so important in selling your home? It forms potential buyers’ first impressions of your home. Curb appeal sets the tone for your entire home. Buyers associate the condition of the exterior and landscape with the condition of the interior. Your home's curb appeal must invite buyers to view the rest of the property. In a buyer's market, curb appeal can mean the difference between a home that sells quickly for the asking price and a home that sells after months of sitting on the market for below the asking price.

Considering selling your home? Give us a call, text or email. We would love to provide you with good advice to improve your homes' curb appeal.

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Buying a Home? Consider COST not just Price

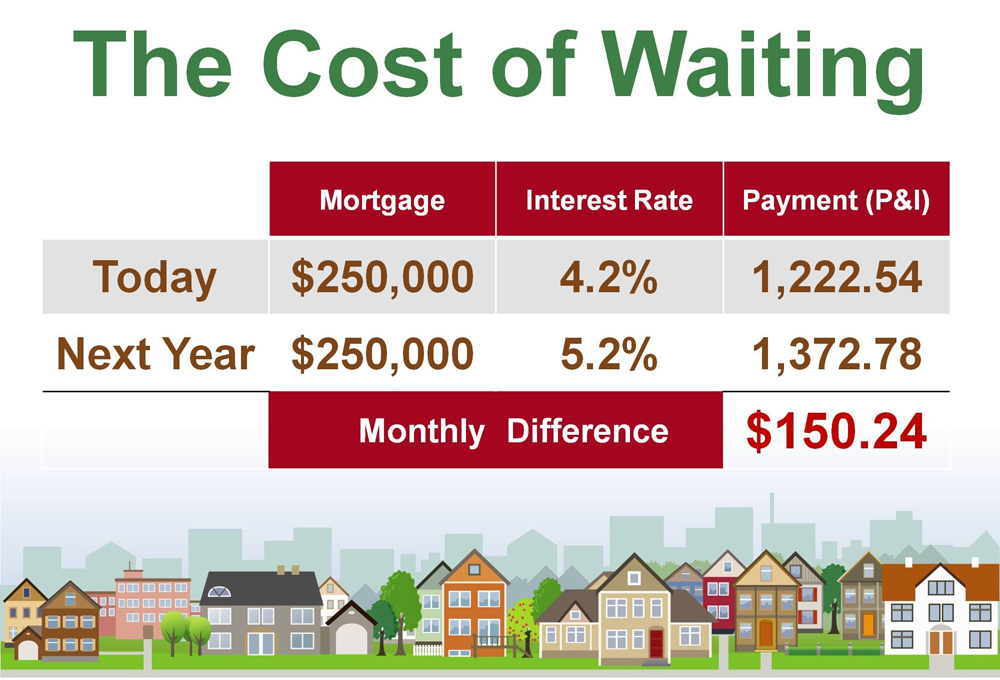

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

Last month, the Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac all projected that mortgage interest rates will increase by about one full percentage over the next twelve months. We also know that many experts are calling for home prices to also increase over the next year.

What Does This Mean to a Buyer?

Here is a simple demonstration of what impact an interest rate increase would have on the mortgage payment of a home selling for approximately $250,000 even if home prices don’t increase:

Considering a home purchase, give us a call, text or email, we would love to help you find your new home, whether it's your first or your tenth!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Homes Selling Faster Than Previous Year

By: Ashley Harris

By: Ashley Harris

Nationwide, homes listed for sale on Zillow were selling at a rapid clip, to the tune of a month faster in September than a year ago, according to a new analysis. Zillow measured homes sold on the real estate marketplace, and as a whole homes in September spent a median of 86 days on Zillow, down 30 days from 116 days in September 2012.

Among the 30 largest metro markets covered by Zillow in September, homes moved the fastest and spent the fewest days listed on the site in the Bay Area (48 days); Sacramento, California (59 days); and Dallas, Texas (60 days). Homes sold faster this September compared to last September in 30 of the largest metros. Those metros include Las Vegas (44 days faster), Sacramento (43 days faster), and San Antonio (37 days faster).

Zillow calculated the median number of days listings spent on Zillow, at the national, metro, and county levels, dating to January 2010. In order to correct for homes that are listed, then removed and re-posted with new prices, Zillow considered multiple listings within 40 days at the same address as one listing. Since the beginning of 2010, homes nationwide have spent a median of 119 days on Zillow before being sold or taken off the market.

“The declining inventory of for-sale homes over the past year naturally creates pressure for buyers to more quickly snap up the inventory that is on the market. This demand has been fueled by huge resets in home prices since market peak, historically low mortgage rates and a slowly improving broader economic climate,” said Dr. Stan Humphries, Zillow chief economist.

“Home shoppers in today’s environment need to be prepared to move quickly, with pre-approvals in place and an established sense of what they’re willing to pay for a home,” he continued. “But even though things are moving fast, buyers should resist the urge to enter into bidding wars or pay prices they’re uncomfortable with. We do expect that this need for speed will abate in the near-term as mortgage rates rise and more inventory becomes available because of new construction and declining negative equity.”

Are you curious about housing inventory in your neighborhood? Give us a call, text or email, we love to talk about real estate!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Corporate and Individual Relocation

Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world.

Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world.

Leading Real Estate Companies of the World® is a global network of over 500 premier real estate firms with 4,000 offices and 120,000 sales associates (brokers) in over 40 countries around the world. Our members dominate the US list of top 500 real estate firms.

Give us a call, text or email today, we would love to help you with your relocation needs!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Windermere, Real Estate, Northwest, Seattle, Mill Creek, Greenwood, Broadview, Home, Purchase, Sell

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Interest Rates Are Projected to Rise

Interest Rates Are Projected to Rise by guest blogger

by guest blogger