Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

– See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Pace of sales hits 5.36M a year during third quarter, best since 2007 – See more at: http://www.inman.com/2013/11/06/home-prices-post-highest-annual-gain-in-nearly-8-years/#!

Pace of sales hits 5.36M a year during third quarter, best since 2007

Home prices in most metropolitan areas grew significantly in the third quarter, with the national median price rising at its fastest annual clip in nearly eight years, according to the National Association of Realtors (NAR).

During the same period, existing homes sold at the fastest annual rate recorded in more than six years, according to NAR’s latest quarterly report on metro area median prices and affordability.

Despite the robust price growth, NAR estimated that potential buyers still had adequate income in most areas to purchase a home in the third quarter. Nonetheless, market momentum is changing, according to Lawrence Yun, chief economist at NAR.

“Rising prices and higher interest rates have taken a bite out of housing affordability,” Yun said. “However, we have the ongoing situation of more buyers than sellers in the market, so lower sales will help to take the pressure off home price growth and allow them to rise slowly at a single-digit growth rate in 2014.”

The national median existing single-family home price increased by 12.5 percent year over year to $207,300 in the third quarter, the strongest year-over-year gain since the fourth quarter of 2005 when it shot up 13.6 percent, according to the trade group.

In the second quarter, the median price reportedly rose 12.2 percent year over year.

Meanwhile, NAR said existing-home sales jumped 5.9 percent to a seasonally adjusted annual rate of 5.36 million in the third quarter from 5.06 million in the second quarter.

On an annual basis, they reportedly increased 13 percent. The third-quarter pace of sales was the highest recorded since the first quarter of 2007, when it hit 5.66 million, NAR said.

The report’s findings also highlighted the market’s sharp inventory shortage.

At the rate of sales in the third quarter, the existing-home inventory of 2.21 million homes for sale would have cleared in just five months, down from 5.9 months in the third quarter of 2012.

Are you curious what your home might be worth? Give us a call, text or email. We'ed be to provided you with a comparative market analysis of your home, condominum or multi-family home.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

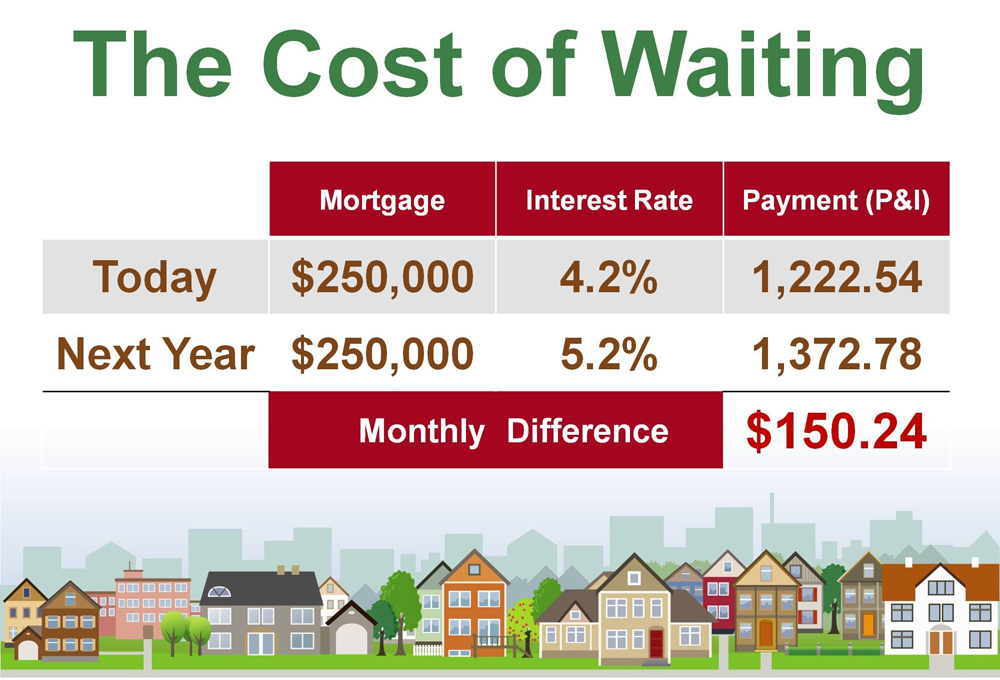

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

By: Ashley Harris

By: Ashley Harris Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world.

Relocating to Seattle or out of the area? We are now Windermere Real Estate Relocation Specialists. We can get you or anyone you know in touch with a reputable broker anywhere in the world. by

by