"One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

"One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

– Freddie Mac, March 24, 2014

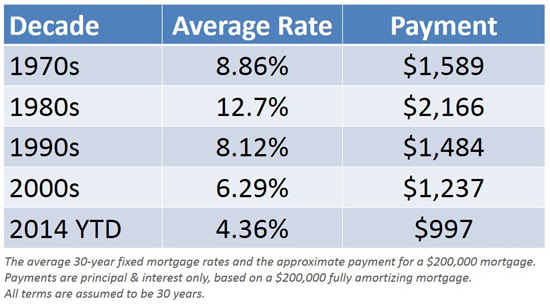

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to the less than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their new blog, explained that current rates are still extremely low compared to historic averages:

"The all-time record low – since Freddie Mac began tracking mortgage rates in 1971 – was 3.31% in November 2012. Conversely, the all-time record high occurred in October of 1981, hitting 18.63%. That's more than four times higher than today's average 30-year fixed rate of 4.32% as of March 20…rates hovering around 4.5% may be high relative to last year, but something to celebrate compared to almost any year since 1971."

If you are thinking of buying a home, waiting for a dramatic decrease in mortgage rates might not make sense. Give us a call or text today and let us help you find your new home, we will guide you every step of the way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link